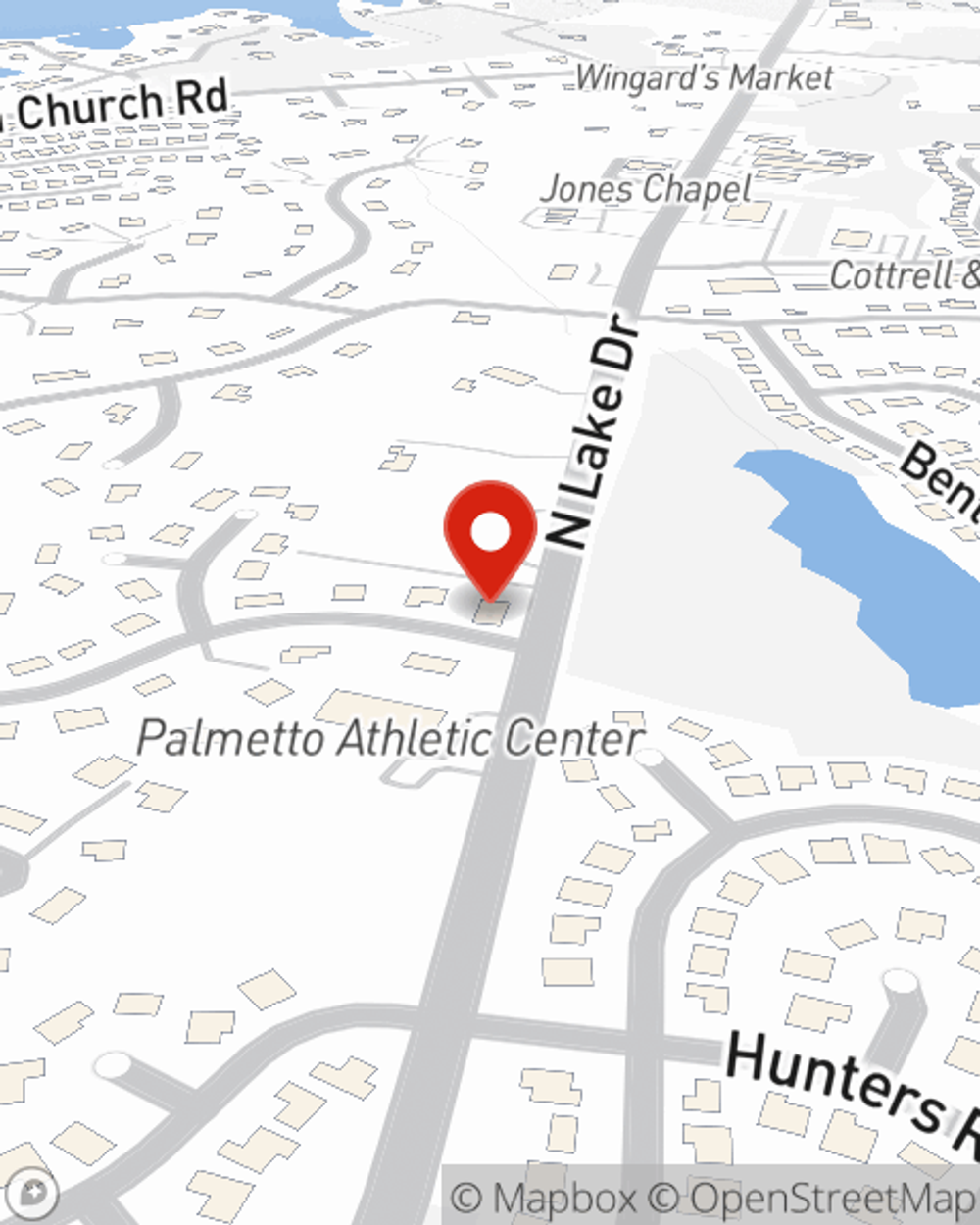

Homeowners Insurance in and around Lexington

Lexington, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Being a homeowner isn’t always easy. You want to make sure your home and the possessions in it are protected in the event of some unexpected accident or catastrophe. And you also want to be sure you have liability insurance in case someone gets hurt on your property.

Lexington, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Agent Misty Stathos, At Your Service

State Farm Agent Misty Stathos is ready to help you prepare for potential mishaps with reliable coverage for your home insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Misty Stathos can help you submit your claim. Find your home sweet home with State Farm!

Ready for some help creating your homeowners insurance plan? Get in touch with agent Misty Stathos's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Misty at (803) 951-9151 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Wildfire safety tips: What to do before and after a wildfire

Wildfire safety tips: What to do before and after a wildfire

Learn essential wildfire safety tips to help protect your family and property. Discover how to prepare for wildfires and recover safely afterward.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Misty Stathos

State Farm® Insurance AgentSimple Insights®

Wildfire safety tips: What to do before and after a wildfire

Wildfire safety tips: What to do before and after a wildfire

Learn essential wildfire safety tips to help protect your family and property. Discover how to prepare for wildfires and recover safely afterward.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.