Business Insurance in and around Lexington

Calling all small business owners of Lexington!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, a surety or fidelity bond and errors and omissions liability.

Calling all small business owners of Lexington!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

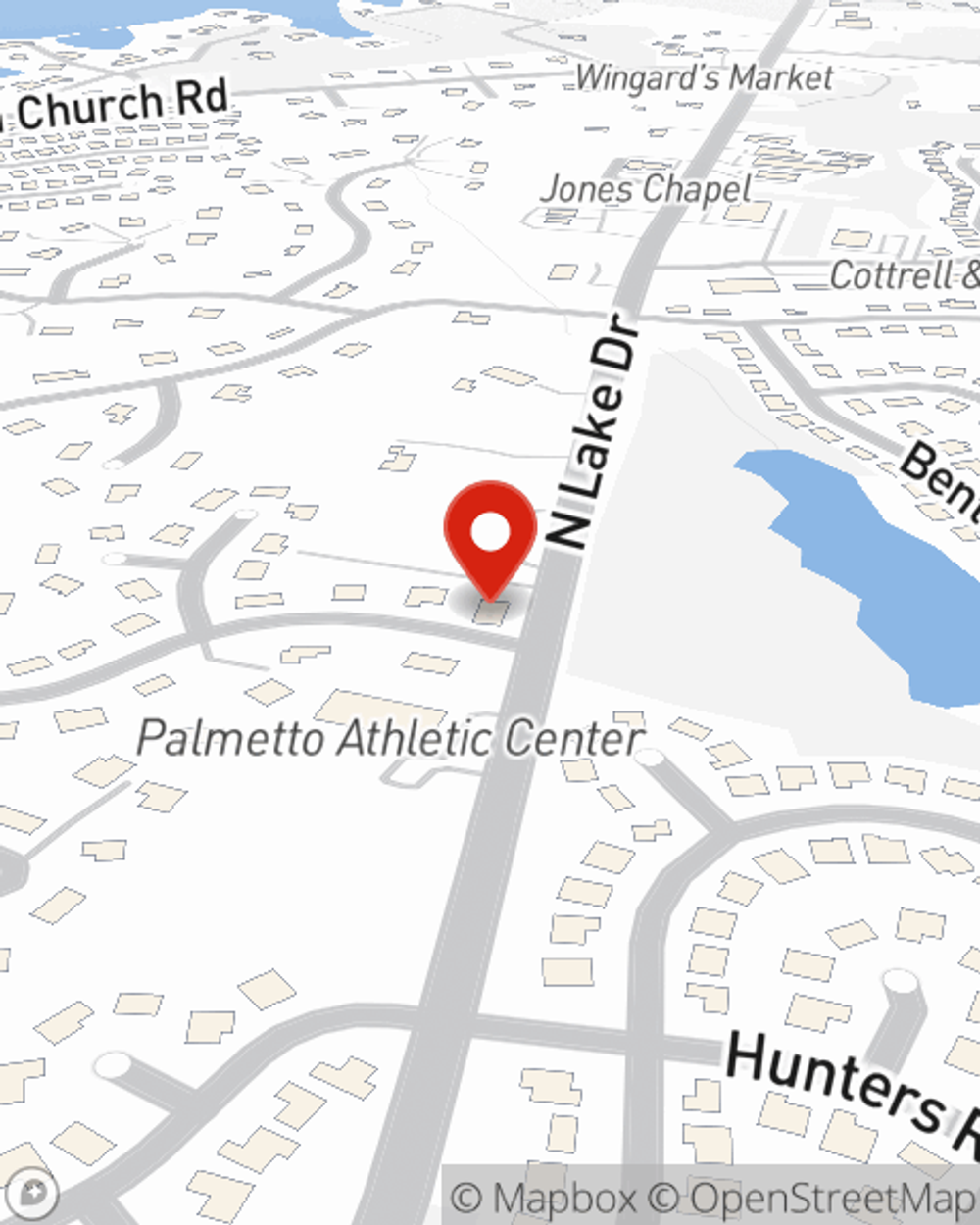

When you've put so much personal interest in a small business like yours, whether it's a farm supply store, a tailoring service, or a dance school, having the right protection for you is important. As a business owner, as well, State Farm agent Misty Stathos understands and is happy to offer personalized insurance options to fit what you need.

Agent Misty Stathos is here to discuss your business insurance options with you. Contact Misty Stathos today!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Misty Stathos

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.